how much state tax do you pay on a 457 withdrawal

Are distributions from a state deferred section 457 compensation plan taxable by New York State. A 457b plan is a tax-advantaged retirement plan restricted to state and local public governments and qualifying tax-exempt institutions.

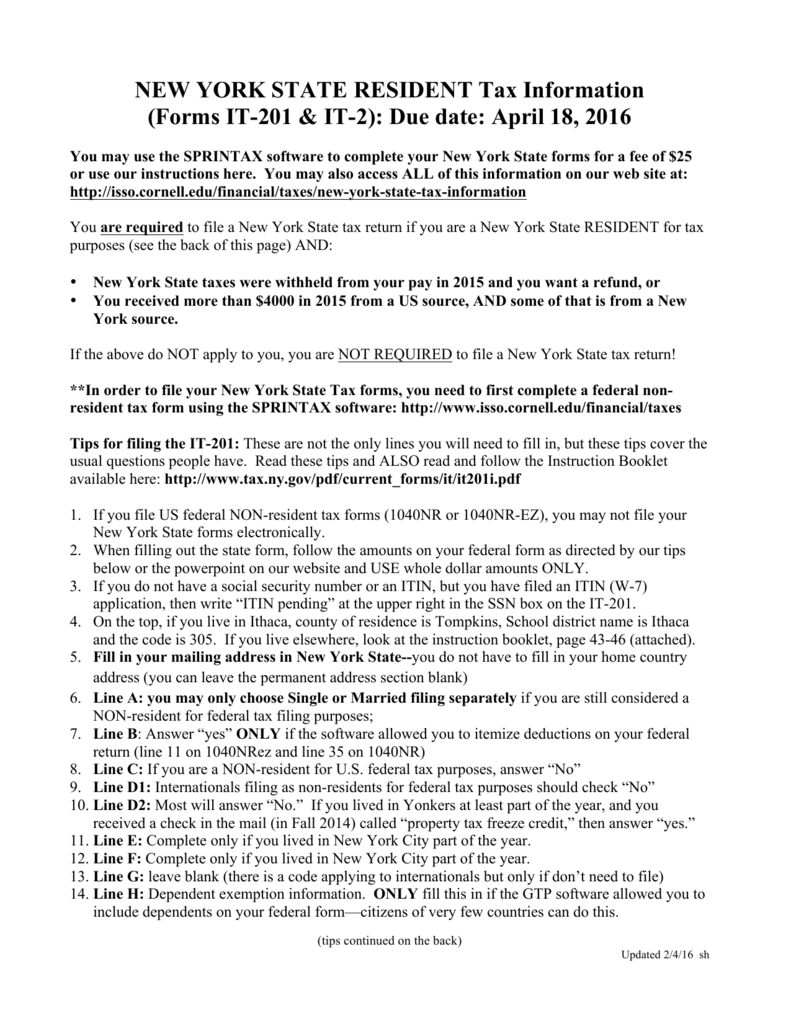

Isso New York State Tax Information Instructions We Are Not Tax Experts We Are Volunteers If You Have A Complicated Tax Question You May Need To Seek Ppt Download

New York Treatment of Distributions relating to Section 457 Deferred Compensation Plans.

. Market Trading Essentials March 12 2022. If you have a 457b you can withdraw funds from the account without facing an early withdrawal penalty. Basically any amount you withdraw from your 401k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return.

The current state marginal tax rate you expect to pay on any additional income or taxable distributions. But if youve been saving in a 403b youll take a 10 penalty surtax on any distributions you take before you hit age 595. What Is a 457 Plan.

5 457 b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457 b plans that are not directly rolled over to an IRA or other eligible retirement plan be subject to federal income tax withholding at the rate of 20. 1730 New Brighton Blvd. For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59 ½.

All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn. All withdrawals are taxable regardless of the participants age. Your age and employment status.

The type of Plan you have 401k or 457. The current state marginal tax rate you expect to pay on any additional income or taxable distributions. 457 Plan Withdrawal indicates required.

457 Plan Withdrawal Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. Unlike other tax-deferred retirement plans such as IRAs or 401ks you wont face a 10 percent early distribution penalty even if youre under age 59 ½. If I can spread my distribution across three-years to keep within 24 federal income tax bracket.

However distributions received after the pensioner turned 59 12 would qualify for the private pension and annuity income exclusion of up to 20000. Press spacebar to hide inputs. For example if you take a 15000 distribution youll owe income tax on the distribution but you.

If you have a 457 f plan at. How much tax do you pay on a 457 withdrawal. 457 Plan Withdrawal Calculator Definitions.

In most circumstances an early withdrawal triggers a penalty equal to 10 percent of the withdrawal amount. Planning on utilizing CARES act to withdraw all 457 b contributions 56k. Enter an amount between 0 and 10000000.

Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money. Employer withholds all federal and state taxes end of year. A 50 nondeductible excise tax.

As with a 401k plan you can get a tax deduction on money you contribute to a 457b plan and your earnings grow on a tax-deferred basis. Amount to withdraw. KJE Computer Solutions Inc.

Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money. For example if you withdraw 10000 you must pay your taxes and then a 1000 penalty. PMB 111 Minneapolis MN.

Withdrawals from a 457b plan are highly regulated so you may not be able to access the. The current state marginal tax rate you expect to pay on any additional income or taxable distributions. Any amount you withdraw from your 457 account has taxes withheld at 20.

Similar to 401 ks and 403 bs all contributions into 457 plans grow tax-free but early withdrawals are. 140k taxable gross income 24k federal tax withheld and 16k state tax withheld. This entry is required.

When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. Use this calculator to see what your net withdrawal would be after taxes are taken into account. Theres a hefty penalty for failing to take a required minimum distribution.

Isso New York State Tax Information Instructions We Are Not Tax Experts We Are Volunteers If You Have A Complicated Tax Question You May Need To Seek Ppt Download

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Traditional Ira

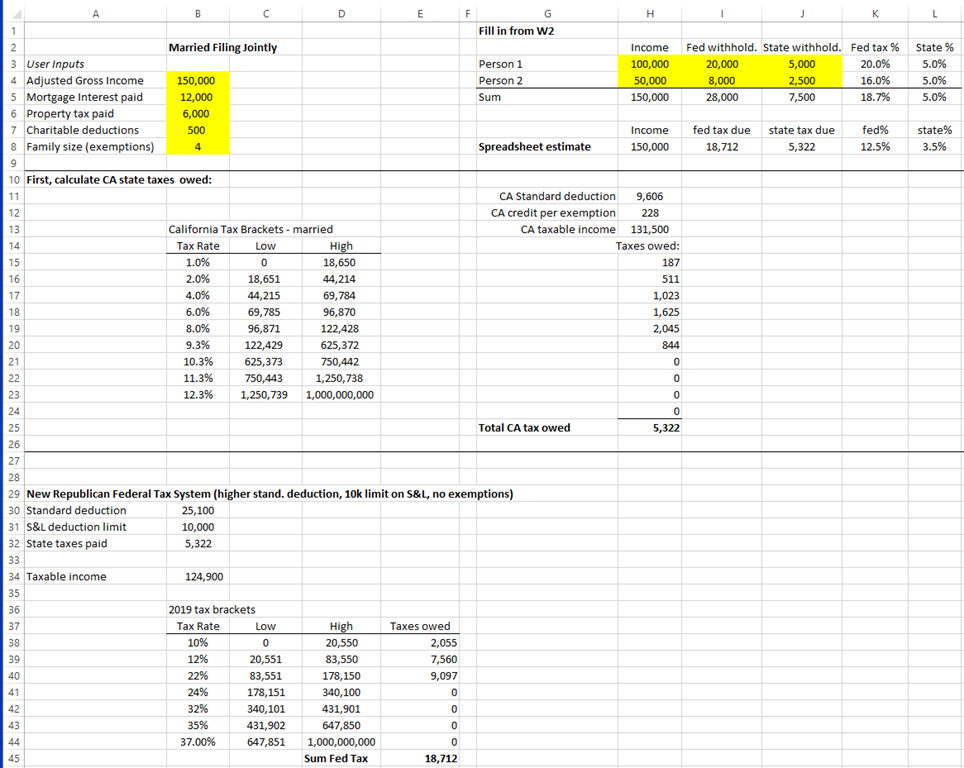

Personal Finance Archives Spreadsheetsolving

Isso New York Resident Tax Forms With Relevant Instruction Sections

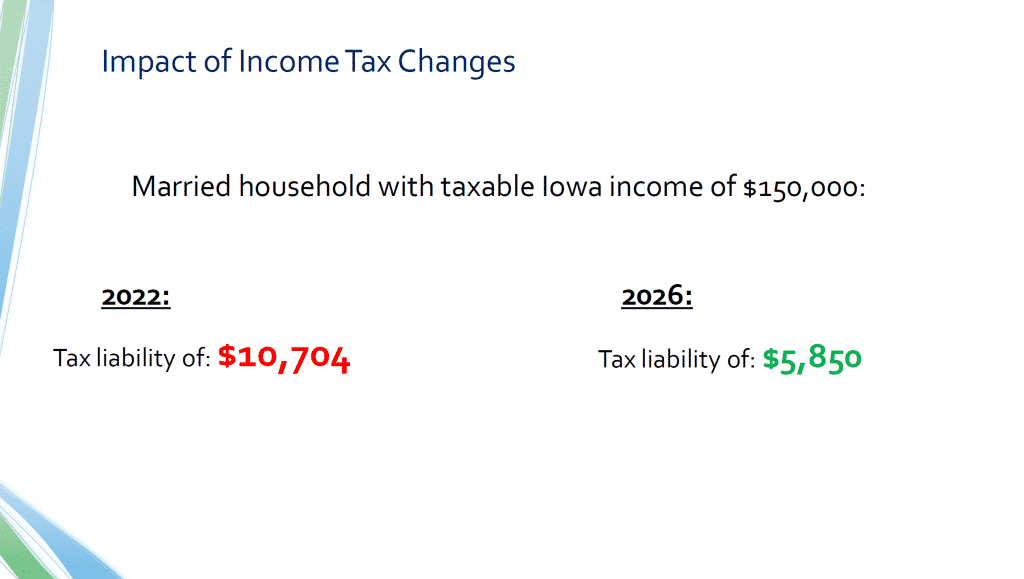

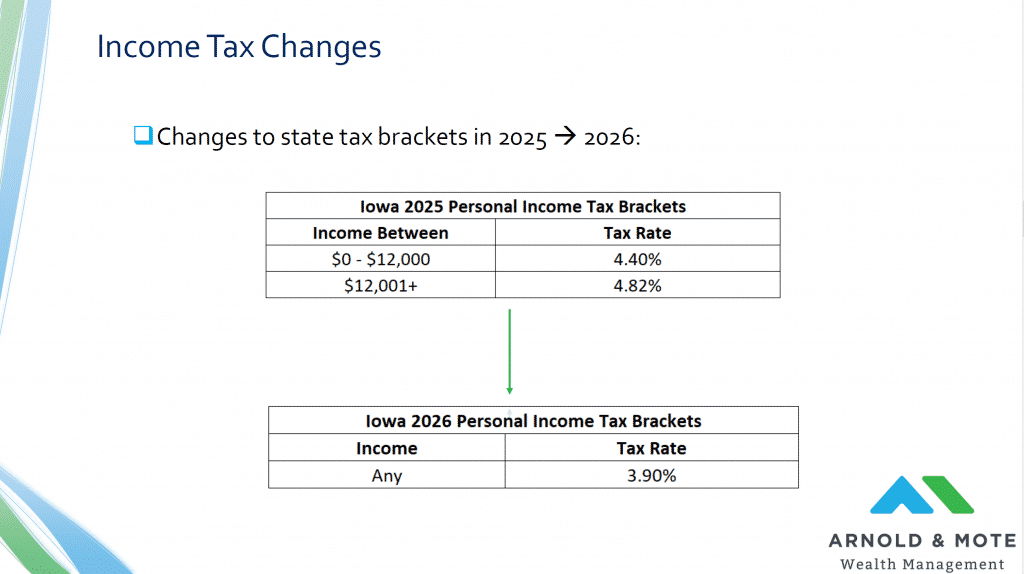

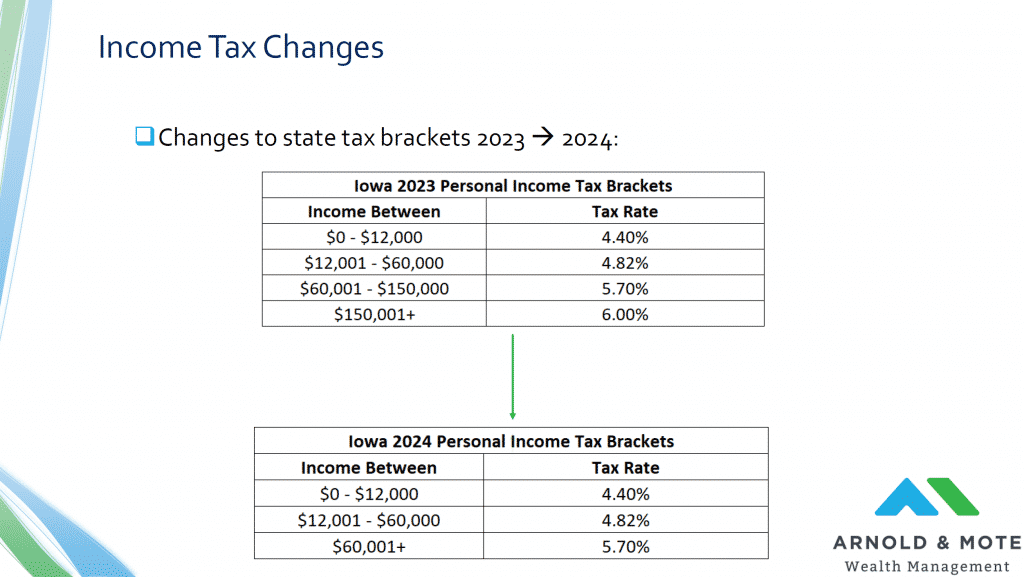

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

A Carbon Tax Wave 7 States Considering Carbon Pricing To Fight Climate Change Climatechange Carbon Climate Change Policy Climate Change Climate Warming

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax

Understanding Your W 2 Controller S Office

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

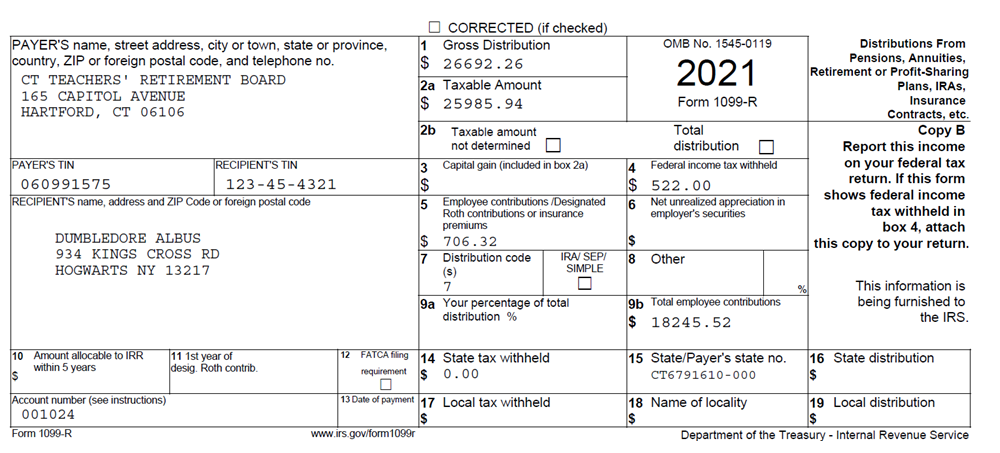

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Pdf New York State Non Resident Tax Information Forms It 203 And It 203 B Aashish Sharma Academia Edu

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

Moving Out Of State Don T Forget About The Source Tax Mullin Barens Sanford Financial

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax