rhode island tax table 2020

The income tax withholding for the State of Rhode Island includes the following changes. Web less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

State Government Tax Collections Total Taxes In Rhode Island Ritotltax Fred St Louis Fed

Find your income exemptions.

. Pay Period 15 2020. Web Rhode Islands 2022 income tax ranges from 375 to 599. We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation.

Web The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Any income over 150550 would be. Web Rhode Island Tax Brackets for Tax Year 2021.

Web How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. How Income Taxes Are. Tax expenditures are legal mandates that provide preferential tax treatment to taxpayers.

The annualized wage threshold. The income tax withholding for the State of Rhode Island includes the following changes. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax.

Web More about the Rhode Island Tax Tables Individual Income Tax TY 2021 We last updated the Income Tax Tables in January 2022 so this is the latest version of Tax Tables fully. Find your pretax deductions including 401K flexible. Web Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

There are -939 days left until Tax Day on April 16th 2020. Pay Period 15 2020. If your taxable income is larger than 100000 use the Rhode Island Tax Computation.

This form is for income earned. Employees must require employees submit state. Web Rhode Island Income Tax Rate 2022 - 2023.

Web 2022 Rhode Island Sales Tax Table. The annualized wage threshold. Web More about the Rhode Island Tax Tables.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Web Download or print the 2021 Rhode Island Tax Tables Income Tax Tables for FREE from the Rhode Island Division of Taxation. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to.

Web In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. Web The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020.

Web 2020 Rhode Island Tax Expenditures Report.

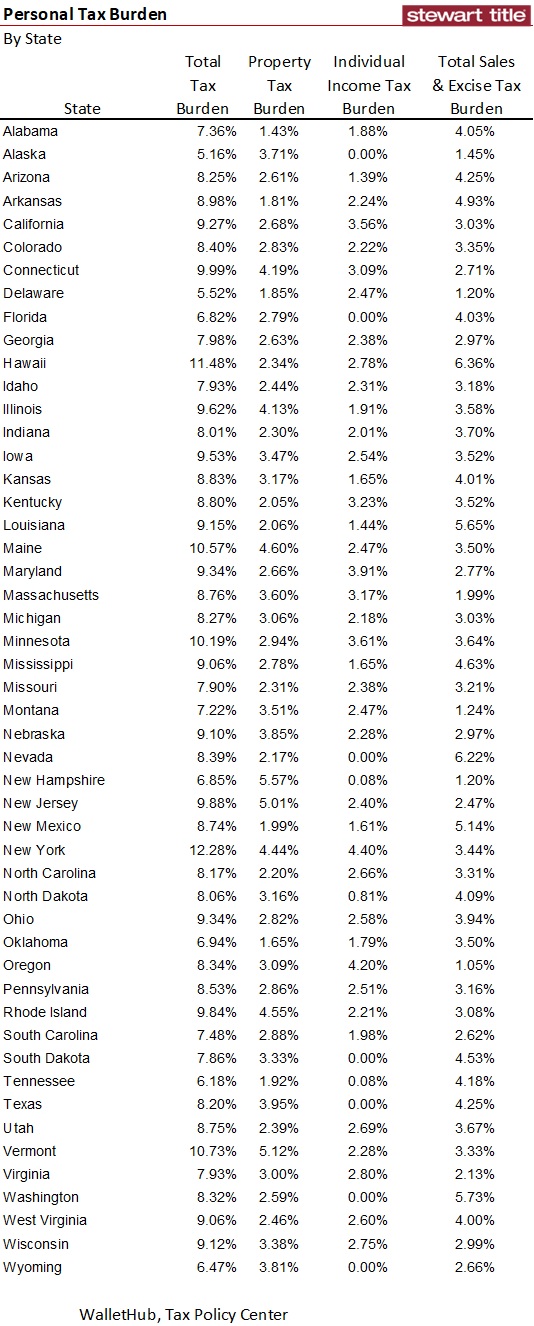

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Rhode Island Income Tax Ri State Tax Calculator Community Tax

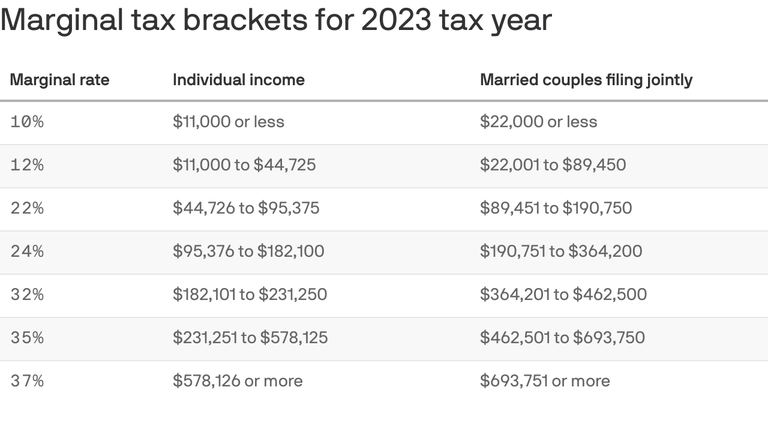

Here Are The Federal Income Tax Brackets For 2023

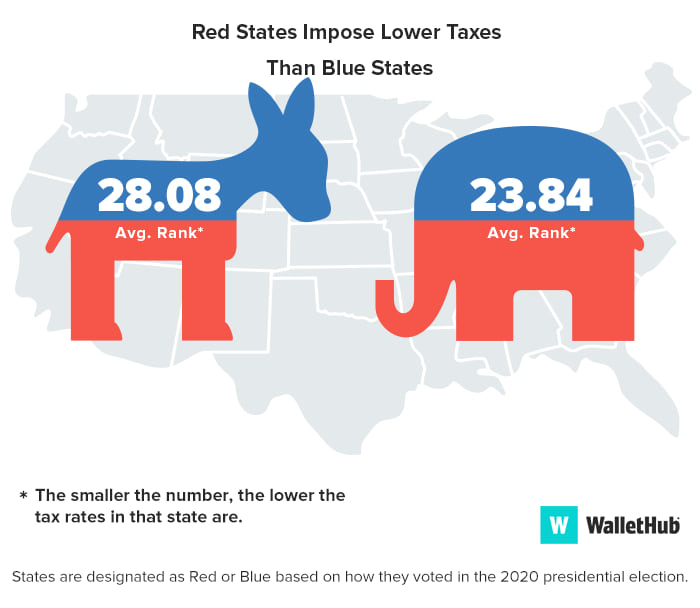

States With The Highest Lowest Tax Rates

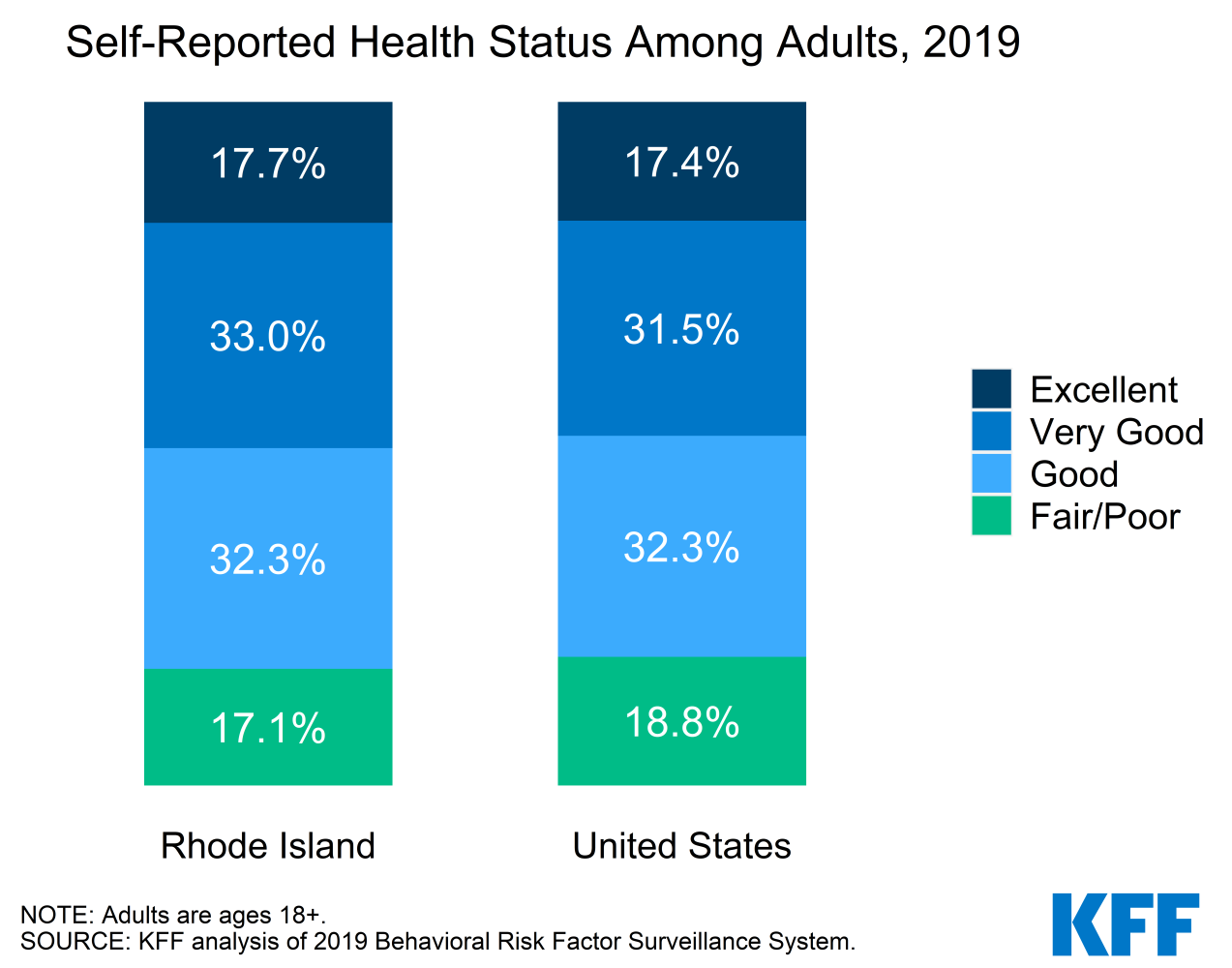

Election 2020 State Health Care Snapshots Rhode Island Kff

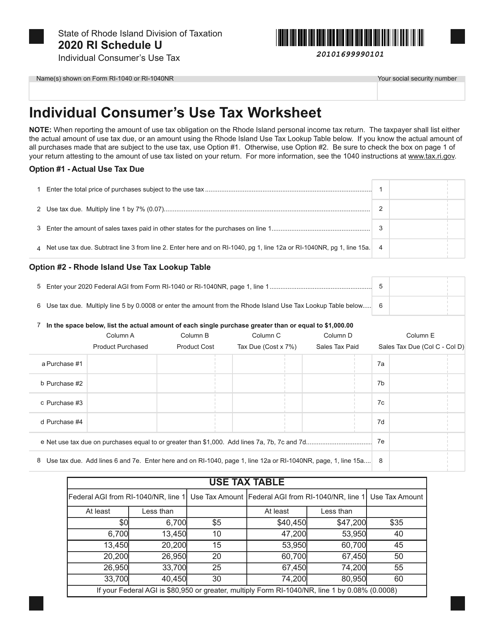

Schedule U Download Fillable Pdf Or Fill Online Individual Consumer S Use Tax 2020 Rhode Island Templateroller

Quick Update For Dynamics Gp Users Tax Tables And Hotfix

2020 Waterfire Event Schedule Waterfire Providence

Individual Income Tax Structures In Selected States The Civic Federation

Basics Beyond Tax Flash January 2020 Basics Beyond

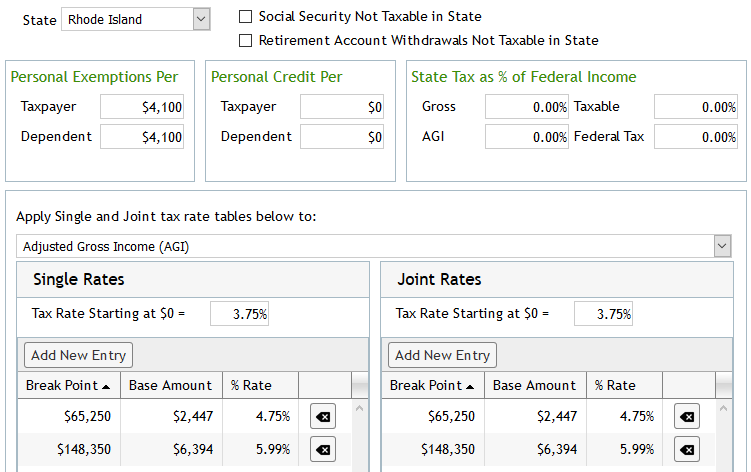

State Income Taxes Updates For 2020 Moneytree Software

Tax Withholding For Pensions And Social Security Sensible Money

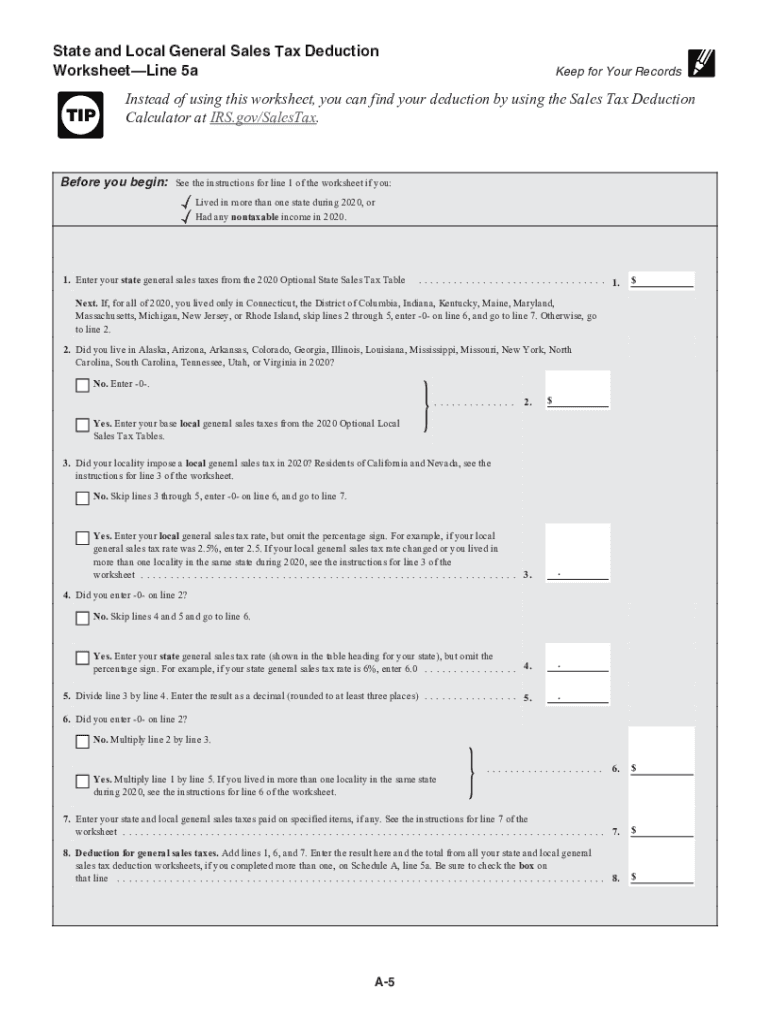

2020 Form Irs Instructions 1040 Schedule A Fill Online Printable Fillable Blank Pdffiller

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Ohio Collected 34 9b In State Taxes In 2021 9th Highest In Country Cleveland Com

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation